Blog

Exclusive to Jenkins: Standard Federal Tax Reporter Now on HeinOnline

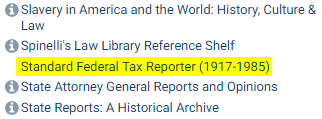

The Standard Federal Tax Reporter is now available only via Jenkins' HeinOnline subscription! HeinOnline's coverage includes historic editions 1917 through 1985. This collection can be found in the alphabetical list of databases:

Once in the Standard Federal Tax Reporter, users can use the top search bar to search across all available editions of the Reporter:

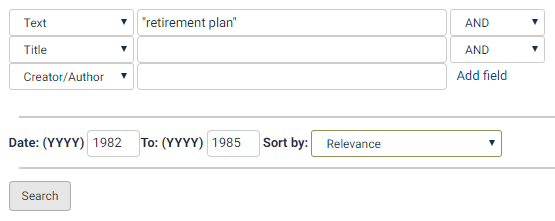

To search an individual year or a year range, use the "Advanced Search" feature:

The Standard Federal Tax Reporter, a CCH product familiar to tax practitioners, includes many documents produced by the Treasury Department and the Internal Revenue Service. Wolters Kluwer describes this title as "a comprehensive collection of up-to-date federal income tax information" that "cut(s) through the technicalities to give you a clear, complete picture of federal income tax law". The Standard Federal Tax Reporter includes the following document types:

- Announcements

- Commissioner Delegation Orders

- Executive Orders

- General Counsel's Memoranda

- International Revenue News Releases

- Letter Rulings

- Notices

- Revenue Procedures

- Revenue Rulings

- Treasury Decisions

- Treasury Department News Releases

- Treasury Department Orders

- And more!

Looking for years not available on HeinOnline? Jenkins maintains this title in print going back to 1951. The most recent year is available in the General Collection and prior years are found in the Historic Collection.

For more information about the Standard Federal Tax Reporter, see the product page from Wolters Kluwer.

Have more federal tax questions? See the Federal Taxation Research Guide for a listing of the tax resources available at Jenkins.